The S&P 500 (Standard & Poor’s 500) is one of the most important and widely followed benchmarks of U.S. stock market performance. Here’s a detailed breakdown, covering its purpose, composition, how it’s calculated, how to invest, and its significance:

1. What is the S&P 500?

- Market Capitalization-Weighted Index: The S&P 500 is a stock market index that tracks the performance of 500 of the largest publicly traded companies in the United States. “Market capitalization” means the total value of a company’s outstanding shares (share price x number of shares). Larger companies have a bigger influence on the index’s movement.

- Represents ~80% of the U.S. Equity Market: These 500 companies represent approximately 80% of the total U.S. equity market capitalization, making it a good proxy for the overall health of the American economy.

- Not Just a List: It’s not simply a list of 500 companies. It’s a weighted index, meaning the impact of each company on the index’s value is proportional to its size.

- Managed by S&P Dow Jones Indices: The index is maintained by S&P Dow Jones Indices, a division of S&P Global.

2. Composition: Who’s Included?

- Large-Cap Focus: The S&P 500 primarily includes large-cap companies (companies with a large market capitalization).

- Selection Criteria (Key Requirements):

- Market Capitalization: Generally, a company must have a market capitalization of at least $14.5 billion (as of January 2024).

- Liquidity: Shares must be actively traded.

- Public Float: A sufficient number of shares must be available for public trading.

- Profitability: Companies generally need to have positive earnings for a certain period.

- U.S. Company: Must be a U.S. company.

- Index Committee Discretion: An S&P Dow Jones Indices committee makes the final decisions on additions and removals.

- Sector Representation: The S&P 500 is diversified across various sectors, including:

- Technology (around 28-30%): Apple, Microsoft, Amazon, Alphabet (Google), Nvidia

- Healthcare (around 13-15%): UnitedHealth Group, Johnson & Johnson, Pfizer

- Financials (around 12-14%): Berkshire Hathaway, JPMorgan Chase, Visa

- Consumer Discretionary (around 10-12%): Tesla, Home Depot, McDonald’s

- Communication Services (around 8-10%): Meta (Facebook), Comcast

- Industrials (around 8-10%): Boeing, Caterpillar

- Consumer Staples (around 7-9%): Procter & Gamble, Coca-Cola

- Energy (around 4-6%): ExxonMobil, Chevron

- Utilities (around 3-4%): NextEra Energy

- Real Estate (around 3-4%): American Tower, Prologis

- Materials (around 2-3%): Linde, Freeport-McMoRan

- Changes Happen: Companies are added and removed from the index periodically to reflect changes in the market.

3. How is the S&P 500 Calculated?

- Market Capitalization-Weighted: The index value is calculated using a weighted average of the market capitalization of each of the 500 companies.

- Float-Adjusted: The calculation uses the “float-adjusted” market capitalization, meaning only the shares available for public trading are considered (excluding shares held by insiders or governments).

- Divisor: A divisor is used to maintain the index’s historical continuity. This is adjusted for events like stock splits, dividends, and company changes to prevent these events from artificially affecting the index value.

- Real-Time Updates: The index is calculated and updated continuously throughout the trading day.

4. How to Invest in the S&P 500

- Index Funds: The most common way to invest is through S&P 500 index funds. These funds aim to replicate the performance of the index.

- Mutual Funds: Actively managed funds that hold the same stocks as the S&P 500. Often have higher expense ratios.

- Exchange-Traded Funds (ETFs): Trade like stocks on an exchange. Generally have lower expense ratios than mutual funds. Popular ETFs include:

- SPY (SPDR S&P 500 ETF Trust): The largest and most liquid S&P 500 ETF.

- IVV (iShares CORE S&P 500 ETF): Another popular, low-cost option.

- VOO (Vanguard S&P 500 ETF): Known for its very low expense ratio.

- Direct Stock Ownership: You could theoretically buy all 500 stocks individually, but this is impractical and expensive for most investors.

- Futures Contracts: More sophisticated investors can use S&P 500 futures contracts to gain exposure to the index.

5. Why is the S&P 500 Important?

- Benchmark for Performance: It’s a widely used benchmark for measuring the performance of investment portfolios. Fund managers are often evaluated based on how their returns compare to the S&P 500.

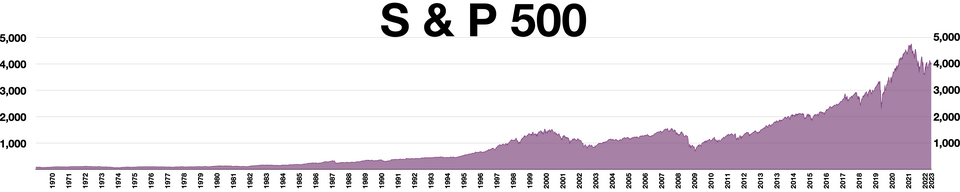

- Economic Indicator: The S&P 500 is often seen as a barometer of the overall health of the U.S. economy.

- Investment Tool: Provides a simple and cost-effective way for investors to gain broad exposure to the U.S. stock market.

- Basis for Derivatives: Used as the underlying asset for various financial derivatives, such as options and futures.

- Media Reporting: Frequently reported in financial news, making it a familiar metric for the general public.

6. Things to Keep in Mind

- Past Performance is Not Indicative of Future Results: Just because the S&P 500 has performed well in the past doesn’t guarantee it will continue to do so.

- Market Volatility: The S&P 500 can experience significant fluctuations in value, especially during times of economic uncertainty.

- Concentration Risk: The index is heavily weighted towards a few large companies, particularly in the technology sector. This can create concentration risk.

- Expense Ratios: When investing in index funds or ETFs, pay attention to the expense ratio, which is the annual fee charged to manage the fund.

Resources for More Information

- S&P Dow Jones Indices: https://www.spglobal.com/spdji/en/indices/equity/sp-500/

- Investopedia (S&P 500): https://www.investopedia.com/terms/s/sp500.asp

- Yahoo Finance (S&P 500): https://finance.yahoo.com/quote/%5EGSPC/

Disclaimer: I cannot provide financial advice. This information is for general knowledge and educational purposes only. Always consult with a qualified financial advisor before making any investment decisions.