The Dow Jones Industrial Average (DJIA), often simply called “the Dow,” is one of the most widely recognized stock market indices in the world. Here’s a detailed look at what it is, how it works, its history, its strengths and weaknesses, and how to track it:

What is the DJIA?

- A Price-Weighted Index: The Dow is a price-weighted average of 30 large, publicly owned companies based in the United States. This means that stocks with higher share prices have a greater influence on the index’s value than those with lower share prices. (This is a key difference from market-cap weighted indices like the S&P 500 – more on that later).

- Represents a Snapshot of the Economy: While the name “Industrial Average” might suggest it only represents industrial companies, it’s evolved to include companies from various sectors, aiming to reflect the overall health of the U.S. economy.

- A Historical Benchmark: It’s the oldest continuing U.S. market index, providing a long-term perspective on market performance.

The 30 Companies (as of November 2025)

Here’s the current list (subject to change – companies are added and removed periodically):

(Note: This list is ordered alphabetically by company name.)

- 3M Co (MMM)

- Amazon.com Inc (AMZN)

- American Express Co (AXP)

- Amgen Inc (AMGN)

- Apple Inc (AAPL)

- Boeing Co (BA)

- Caterpillar Inc (CAT)

- Chevron Corp (CVX)

- Cisco Systems Inc (CSCO)

- Coca-Cola Co (KO)

- Goldman Sachs Group Inc (GS)

- Home Depot Inc (HD)

- Honeywell International Inc (HON)

- International Business Machines Corp (IBM)

- Johnson & Johnson (JNJ)

- JPMorgan Chase & Co (JPM)

- McDonald’s Corp (MCD)

- Merck & Co Inc (MRK)

- Microsoft Corp (MSFT)

- Nike Inc (NKE)

- NVIDIA Corp (NVDA)

- Procter & Gamble Co (PG)

- Salesforce Inc (CRM)

- Sherwin-Williams Co (SHW)

- Travelers Companies Inc (TRV)

- UnitedHealth Group Inc (UNH)

- Verizon Communications Inc (VZ)

- Visa Inc (V)

- Walmart Inc (WMT)

- Walt Disney Co (DIS)

How is the DJIA Calculated?

The calculation is relatively simple:

- Sum of Prices: Add up the stock prices of all 30 companies.

- Divide by the Dow Divisor: Divide the sum by a number called the “Dow Divisor.” This divisor is not 30. It’s a number adjusted over time to account for stock splits, dividends, and other corporate actions that would otherwise artificially change the index’s value. Currently, the Dow Divisor is a small number (around 0.14733).

- The Result: The result is the Dow Jones Industrial Average.

Example (Simplified)

Let’s say the 30 stocks have an average price of $150. The Dow would be: $150 * 30 / 0.14733 = approximately 30,630. (The actual Dow is different due to real-time price fluctuations and the divisor).

History of the DJIA

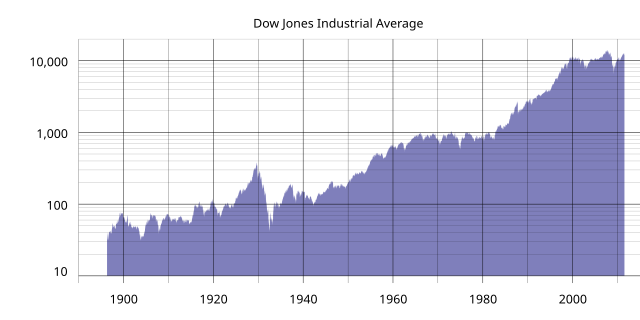

- 1896: Created by Charles Dow, co-founder of Dow Jones & Company, and Edward Jones. It initially included only 12 companies, primarily in the industrial sector (railroads, cotton, gas, sugar, tobacco, and leather).

- Evolution: The composition of the Dow has changed significantly over the years, reflecting shifts in the U.S. economy. Companies have been added and removed to maintain relevance.

- Major Milestones: The Dow has reached numerous milestones, including breaking 1,000 in 1973, 10,000 in 1999, 20,000 in 2017, and 30,000 in 2020.

Strengths of the DJIA

- Historical Significance: Provides a long-term perspective on market trends.

- Simplicity: Easy to understand and calculate (though the divisor is a bit opaque).

- Media Attention: Widely reported in the news, making it a familiar benchmark for investors.

- Blue-Chip Representation: Includes well-established, financially sound companies.

Weaknesses of the DJIA

- Limited Scope: Only 30 companies, which is a small sample of the overall U.S. stock market.

- Price-Weighting: This is its biggest flaw. A stock with a high price, even if its market capitalization is smaller than another company, will have a greater impact on the index. This can lead to distortions.

- Not Representative of the Entire Economy: While it aims to be, it doesn’t fully capture the diversity of the U.S. economy. Technology is heavily represented, but other sectors may be underrepresented.

- Divisor Adjustments: The divisor adjustments, while necessary, can make it harder to interpret the index’s historical performance.

How to Track the DJIA

- Financial Websites: Major financial websites like Yahoo Finance, Google Finance, Bloomberg, and MarketWatch provide real-time Dow Jones Industrial Average quotes.

- News Outlets: Business news channels (CNBC, Fox Business) and newspapers (Wall Street Journal, Financial Times) regularly report on the Dow.

- Brokerage Accounts: Your brokerage account will typically display the Dow’s current value.

- Dow Jones Website: The official Dow Jones website (https://www.dowjones.com/) provides information about the index.

DJIA vs. Other Indices (S&P 500 & Nasdaq Composite)

| Feature | Dow Jones Industrial Average (DJIA) | S&P 500 | Nasdaq Composite |

|---|---|---|---|

| Number of Companies | 30 | 500 | Over 3,000 |

| Weighting Method | Price-Weighted | Market-Cap Weighted | Market-Cap Weighted |

| Sector Focus | Broad, but historically industrial | Broad, representing the U.S. economy | Heavily weighted towards technology |

| Represents | Large, well-established companies | Large-cap U.S. companies | All companies listed on the Nasdaq exchange |

| Generally Considered | A snapshot of market sentiment | A more comprehensive measure of the U.S. stock market | A gauge of the technology sector |

In conclusion

The Dow Jones Industrial Average is a valuable, though imperfect, indicator of the U.S. stock market’s performance. While its price-weighted methodology and limited scope have drawbacks, its historical significance and widespread recognition make it a crucial benchmark for investors and economists alike. It’s best used in conjunction with other indices, like the S&P 500 and Nasdaq Composite, to get a more complete picture of the market.

Disclaimer: I cannot provide financial advice. This information is for general knowledge and educational purposes only. Always consult with a qualified financial advisor before making any investment decisions.