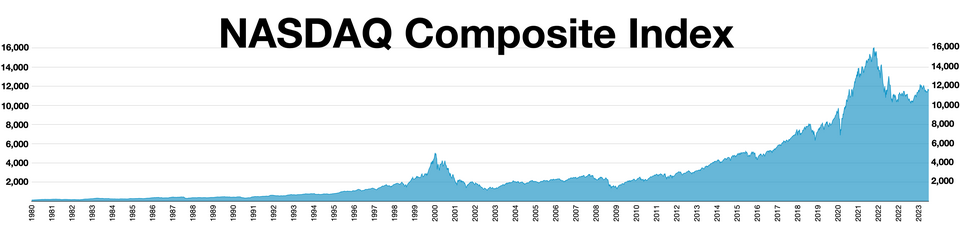

The Nasdaq Composite is a stock market index representing over 3,300 stocks listed on the Nasdaq stock exchange. It’s a key indicator of the overall health of the technology sector and the broader U.S. economy. Here’s a comprehensive overview, covering its history, composition, how it’s calculated, what influences it, and how to invest in it:

1. History & Background

- Founded: February 5, 1971, by the National Association of Securities Dealers (NASD). Initially, it was the world’s first electronic stock market.

- Early Focus: Originally designed to be a more efficient and transparent market for over-the-counter (OTC) stocks – companies that didn’t meet the listing requirements of the New York Stock Exchange (NYSE).

- Growth & Evolution: Over time, the Nasdaq attracted many fast-growing technology companies, becoming synonymous with the tech boom of the 1990s. It has since diversified to include companies from various sectors.

- Now: The Nasdaq is a major global exchange, known for its technology and innovation.

2. Composition: What’s Included?

- Number of Stocks: Over 3,300 stocks (as of late 2023/early 2024). This is significantly more than the S&P 500 (which has 500 companies) or the Dow Jones Industrial Average (which has 30).

- Sector Representation: While heavily weighted towards technology, the Nasdaq Composite includes companies from:

- Listing Requirements: Companies must meet certain financial and corporate governance standards to be listed on the Nasdaq. There are different tiers of listing with varying requirements.

- No Minimum Market Cap: Unlike some other indices, there isn’t a strict minimum market capitalization requirement for inclusion. This means smaller companies can be part of the index.

3. How is the Nasdaq Composite Calculated?

- Market-Capitalization Weighted: This is the key. The index’s value is calculated based on the total market capitalization of all the stocks in the index.

- Market Capitalization = Stock Price x Number of Shares Outstanding

- Weighting: Companies with larger market capitalizations have a greater influence on the index’s movement. A significant price change in a large-cap stock (like Apple or Microsoft) will have a bigger impact than a similar percentage change in a small-cap stock.

- Divisor: A divisor is used to adjust the index value for events like stock splits, dividends, and company additions/deletions, ensuring the index accurately reflects market changes.

- Real-Time Updates: The index is calculated and updated continuously throughout the trading day.

4. What Influences the Nasdaq Composite?

- Technology Sector Performance: Because of its heavy tech weighting, the Nasdaq is highly sensitive to the performance of technology companies. News and trends in the tech sector (e.g., AI, semiconductors, cloud computing) significantly impact the index.

- Economic Conditions: Overall economic growth, interest rates, inflation, and unemployment all play a role. Strong economic growth generally supports stock prices, while recessions tend to depress them.

- Interest Rate Policy: The Federal Reserve’s interest rate decisions have a major impact. Lower rates tend to boost stock prices (making borrowing cheaper for companies and increasing investor appetite for risk), while higher rates can have the opposite effect.

- Geopolitical Events: Global events, such as wars, trade disputes, and political instability, can create market uncertainty and affect stock prices.

- Investor Sentiment: Market psychology and investor confidence (or lack thereof) can drive short-term price fluctuations.

- Earnings Reports: The financial performance of the companies within the index, as reported in their quarterly earnings releases, is a crucial factor.

5. How to Invest in the Nasdaq Composite

You can’t directly invest in an index. Instead, you invest in products that track the Nasdaq Composite. Here are the most common ways:

- Exchange-Traded Funds (ETFs): This is the most popular and often the most cost-effective way. ETFs are baskets of stocks that aim to replicate the performance of an index.

- Popular Nasdaq Composite ETFs:

- Invesco QQQ Trust (QQQ): Technically tracks the Nasdaq-100 (the 100 largest non-financial companies listed on the Nasdaq), which is highly correlated with the Composite. It’s the most actively traded ETF.

- iShares Nasdaq Composite ETF (IXIC): Directly tracks the Nasdaq Composite.

- ProShares Nasdaq Composite ETF (IXN): Another ETF tracking the Nasdaq Composite.

- Popular Nasdaq Composite ETFs:

- Mutual Funds: Some mutual funds focus on technology or growth stocks and may have significant overlap with the Nasdaq Composite. However, mutual funds typically have higher expense ratios than ETFs.

- Index Funds: Similar to ETFs, but typically offered directly by brokerage firms.

- Options & Futures: More sophisticated investors can use options and futures contracts based on the Nasdaq Composite to speculate on its future direction. (High risk)

6. Key Differences: Nasdaq Composite vs. Nasdaq-100 vs. S&P 500

| Feature | Nasdaq Composite | Nasdaq-100 | S&P 500 |

|---|---|---|---|

| Number of Stocks | >3,300 | 100 | 500 |

| Sector Focus | Broad, but heavily tech | Primarily tech (non-financial) | Broad, diversified |

| Weighting | Market-cap weighted | Market-cap weighted | Market-cap weighted |

| Inclusion Criteria | Listed on Nasdaq | Largest 100 non-financial Nasdaq companies | Large-cap U.S. companies |

| Represents | Overall Nasdaq market | Leading Nasdaq companies | Broad U.S. market |

7. Resources for Tracking the Nasdaq Composite

- Nasdaq Official Website: https://www.nasdaq.com/

- Financial News Websites: Bloomberg, Reuters, CNBC, Yahoo Finance, Google Finance

- ETF Provider Websites: iShares, Invesco, ProShares

Disclaimer: I cannot provide financial advice. This information is for general knowledge and educational purposes only. Investing in the stock market involves risk, and you could lose money. Always consult with a qualified financial advisor before making any investment decisions.